Funeral Trust vs. Final Expense Insurance: Which Protects Families Best?

When a loved one passes away, the last thing families want to worry about is money. Two common ways to prepare are through a funeral trust or final expense insurance. Both are designed to help, but the way they work — and who they protect — is very different.

What Is a Funeral Trust?

A funeral trust is a secure, irrevocable account set aside for funeral-related costs.

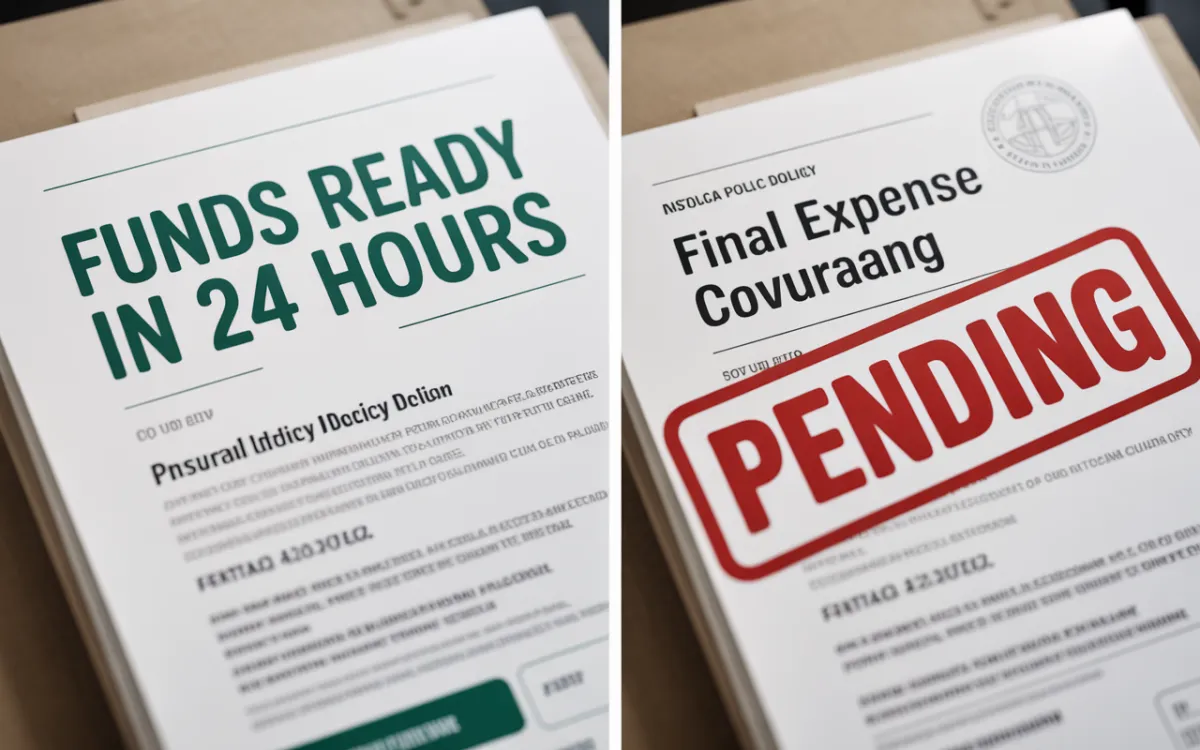

Payouts in 24–48 hours

Medicaid-compliant (protected in spend-downs)

Can be used at any U.S. funeral home

Covers more than just the service — meals, cremation jewelry, memorials, etc.

What Is Final Expense Insurance?

Final expense insurance is a small life insurance policy meant to help cover funeral costs.

Payouts may take weeks to process

Coverage often capped at $5,000–$15,000

Beneficiaries control funds (may or may not go to funeral expenses)

Key Differences at a Glance

Speed: Funeral trust = days, insurance = weeks

Control: Funeral trust guarantees funds go to funeral costs

Medicaid: Funeral trust is protected, insurance usually isn’t

Flexibility: Insurance can be used broadly but lacks safeguards

Both options offer benefits, but only one guarantees your family won’t be left scrambling. A funeral trust provides speed, compliance, and peace of mind.

👉 Ready to explore your options? Book a free consultation today.